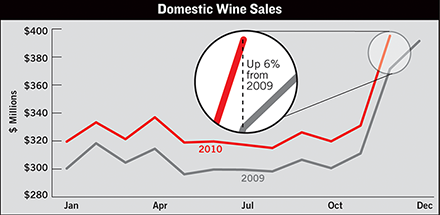

Wine Sales Continue Upward Trend

November off-premise sales 6% higher than 2009

The November numbers marked the start of the usual November-December holiday spike in wine buying, but they also built upon a solid year of sales that averaged a healthy 6% growth for U.S.-produced table wine. Sales of $4.3 billion were scanned at the stores measured by SIRI in the 52 weeks through Nov. 28.

Wines at $20-plus continued to lead all other price segments in rate of growth, with a sizzling 22% gain in dollars over the four week reporting period. It’s not just a sudden surge. Over 52 weeks, the growth rate of $20-and-up wines was just barely lower at 21%, showing how sustained this trend is. This is the highest priced segment in SIRI’s methodology, and while it accounts for less than 3% of the market, it’s an important price-point to many Wines & Vines readers at small wineries.

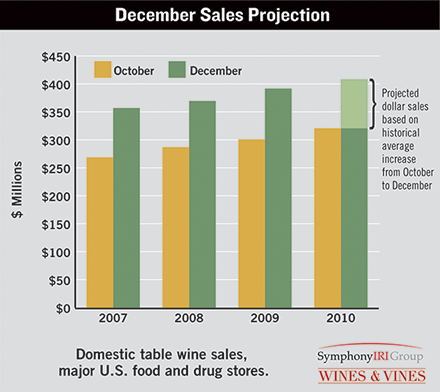

“In the $20-plus segment, the news is not that the sales went up over the previous month,” said Doug Goodwin, SIRI’s VP of client insights for wine, beer and spirits. “That wasn’t the surprise, because they always do in November. It’s the steepness of the incline. November sales this year were almost as good as December sales last year, and December is always the biggest month.”

The highest priced wines were not alone, however. The much bigger segment of wines at $8-$10.99 grew at nearly 12% during the four weeks through Nov. 28. All other price categories of domestic table wines grew, too, except those at less than $3.50 per bottle. High-priced box wines, at the equivalent of $3.50 to $4.99 per 750ml, soared at 25% more dollars than in November 2009.

Blended reds are hot

Trends by varietal over 52 weeks continued to show Pinot Noir sales growing well at 11%, Riesling at 8%, and the huge category of Cabernet Sauvignon at 7%. One particular flavor category that stood out was red blends/Meritage wines. These grew by 14% over all price categories. It was the fastest growing varietal category over 52 weeks. In the recent four-week period it increased nearly 23% from 2009.

Chardonnay, with the biggest dollar share of the table wine market, grew a modest 2% in the most recent four weeks, well under the overall domestic growth rate. Chardonnay sales actually shrank slightly in the magnum size. Still, with $107 million in four-week sales and 21% of the market, Chardonnay is not going anywhere soon.

Syrah/Shiraz wines continued to suffer slower sales than last year, down by 9% in the recent four weeks, and the same over 52 weeks.

Sales by state

California wines account for 70% of all table wines in the SIRI data. It’s no surprise, then, that California’s sales growth was virtually the same as U.S. sales overall, about 6% in four weeks.

Washington state wines rose a respectable 4% in dollars during the most recent four weeks, and have grown at 4% over the current 52 weeks. Oregon table wines gained almost 12% over 52 weeks, slowing to a still-high rate of 10% growth over the recent four-week period.

It is interesting to note that dollar sales in SIRI’s data are rising faster than volume (6% vs. 5% for four domestic table wines). It means that consumers were trending up in price per bottle, most likely by switching to higher priced brands rather than from price increases on their usual brands, according to Goodwin at SIRI.

SHARE »

CURRENT NEWS INDEX »