A Conversation with Craig Wolf

WSWA chief addresses consolidation and the growing influence of mega retailers

As CEO of the Wine & Spirits Wholesalers of America, Craig Wolf manages day-to-day operations of the influential trade association based in Washington, D.C., with the help of an annual budget of $11 million, a staff of 23 and a political action committee. Wolf was trained as a lawyer and served as the WSWA’s general counsel for seven years before taking over the organization’s top spot in 2006.

Pre-WSWA, Wolf served as counsel to the U.S. Senate Judiciary Committee as a trial attorney in the Criminal Division of the Department of Justice and for five years worked as an assistant state’s attorney for Allegany County, Md. He is a major in the U.S. Army Reserve.

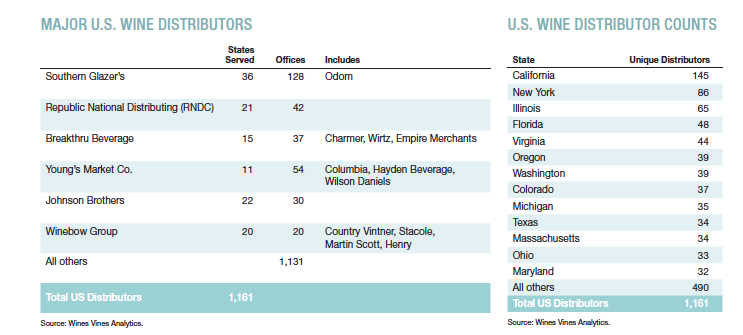

Founded in 1943, WSWA advocates for wholesalers’ interests with state and federal elected officials, the media, regulators and the law-enforcement community. Membership includes 372 wine and spirits wholesalers and brokers operating in all 50 states and the District of Columbia. Wolf estimated that WSWA members handle 80% to 85% of wine and spirits volume in the United States.

Q:Distributor and wholesaler consolidation ranks as a top concern for wineries. Can you reassure small to medium sized wineries that distributors still care about their success?

Craig Wolf: First of all, consolidation’s been happening for the past 20 years in a serious way. Yet if you look at what’s available on the shelves, and available to the consumer, the SKUs have only gone up in our time despite the consolidation.

What’s going to hurt small wineries, what’s going to hurt the craft movement, the innovation, is not the wholesaler consolidation. Wholesalers are going to maintain their SKU level of 15,000 to 30,000 SKUs. What’s going to hurt the brand owners is the retail playing field, and the big box retailers, and the private labels.

What you’re going to see is the squeeze on the shelf space. A lot of big-box guys like Costco, they have minimal SKUs to begin with, and they’re looking for the high volume. Now they’ll throw in a couple local brands to sort of make the portfolio a little broader.

Let’s face it, when you’re talking with Costco, you’re talking 150 to 200 SKUs, that’s it. Now you’ve got some bigger guys like Total Wine that have a huge selection. But if you look at their goals, their goals are private labels.

Q:What’s so bad about chain retailers developing their own private wine brands?

Wolf: Look, we don’t have a problem with anybody who enters the regulated marketplace. But a lot of these large retailers want to change the marketplace.

If you look at what happened in Washington state, that has not had a net benefit necessarily for the consumer. That was an initiative drafted by Costco.

If you look at what actually results when they get their way, and if you look at what they were trying to do in Oregon with trying to privatize Oregon—and Kroger’s is behind that—it wouldn’t have been to the benefit of the consumer in the long run.

What would happen most is the private labels would be the biggest beneficiary of that, not brands. The big brands, they’re going to still go through traditional wholesalers. The private labels were getting an economic advantage going direct.

In the end, the consumer would have more space lost at the local grocery store or liquor store. A lot of these retailers are about volume sales. That’s what they want. They’re not looking to have the expanded SKUs that a consumer—especially a wine consumer—is looking for.

Now if I’m supplier, if I’m a Gallo, I can’t go to a retailer and say, “I’ll pay you money to get the prime end cap here for this month.” It’s illegal. But a retailer who owns a private label and financially benefits from that private label can slot it anywhere they want to. Is that fair?

It presents a real legal issue, from my perspective, as to what their status is and whether the rules apply to them fairly, as they do across the board for wholesalers and suppliers.

Q:Why should wineries want the traditional three-tier system to remain intact?

Wolf: If you think about day-to-day sales, what do you have? You have hundreds of thousands of suppliers from around the world trying to deliver their product to hundreds of thousands retailers around the country, multiple times a week. Now if you’re a retailer and you’re trying to do that without the benefit of a wholesaler, it’s impossible. If you’re a supplier trying to get to a hundred thousand retailers without a wholesaler, it’s impossible.

What wholesalers do is create these tremendous efficiencies. Now, if you remove from wholesalers a large share of the business, that efficiency’s lost. They’re not going to be able to provide the same type of service for small and mid-sized wineries and stores that they are today.

We basically spread out the cost across all sectors. Again, this is a larger picture issue, and as these retailers try to take their lines outside of the traditional system, the losers in the end are going to become the consumer and the small producer. Everybody then is going to be focused on what? The big product. That’s where the money is.

Wholesalers actually serve to protect the supplier now from the pressures of being owned by a retailer. Since we’re not beholden to one supplier or one retailer, we actually benefit the consumer.

It’s a real quandary. We face this every day. The whole mantra of deregulation and direct shipping, whatever you want to call it, direct to retail, is, “Well, it’s great for the consumer. It’s removing the anachronistic three-tiered system.”

But, we do have the best system for alcohol distribution in the country. It’s the safest, the most accountable, the best tax collection and the most consumer friendly.

Q:What advice do you have for smaller wineries looking for distribution?

Wolf: We understand the need out there. We understand the desire. We’re trying to fill that gap. By the way, almost every large wholesaler also has craft wine and craft spirits divisions. Craft divisions help them have dedicated staff people to identify those small wineries, those small craft distillers, that are going to be players in the marketplace.

A lot of small companies come to the WSWA convention, or they come to the wholesaler, and they want national distribution. They want the big guy. I don’t encourage that. I think it’s often wise to start small or regional and build support, build popularity.

You start small, you start regionally. That’s a strategy that some people don’t get, that even if it’s in a franchise state—and I know there’s a fear among wineries, getting stuck in a franchise state—but if you can get a dedicated wholesaler to really like your product, just build your product, guess what’s going to happen? You’re going to get noticed. You’re going to get more attention from everybody else over time.

It takes time. You have to build. Remember our business is a relationship business. A certain strategic patience, if you will, is important.

Q:How is the growth of direct-to-consumer shipping affecting wholesalers?

Wolf: You know—as well as everybody else, probably, in the industry—that we’re not a big fan of direct shipping. People always say it’s because we’re going to be losing business. It’s not about that. We get concerned about taxes, and concerned about local jobs. We’re concerned about the gray market and the black market. You can’t control processes that you can’t regulate and see.

Q:On the regulatory front, why did the WSWA lobby for an increase in the Tax and Trade Bureau’s budget?

Wolf: The label-approval process for wineries has gotten better because we’ve actually pushed for additional funding for our regulators. A couple of years ago, from application to approval was taking up to half a year. Now it’s closer to nine to 10 days. We’re allowing more products to get to market faster.

Q:Are these the best of times for the wine business?

Wolf: They’re the best of times and the worst of times. We’re Dickensian right now. The marketplace is strong; the wholesalers are probably as technologically proficient as they’ve ever been. They’re as responsive as they’ve ever been.

Obviously the third and fourth generation are smarter, they know the local marketplace better than they ever have. In terms of helping retailers and suppliers figure out which products should go where, they’re better than they’ve ever been.

It is also the worst time in that the challenges to the system that has brought us to this point are growing exponentially across the board.

The challenges used to be a one off here and there. Direct shipping? Some wineries were that small exception. They just wanted to be able to ship a small percentage here and there. Now we’re seeing all-out attacks on the system coming from the breweries, and they’re coming now from the Distilled Spirits Council. We’re seeing it from distilleries who want to maybe go direct themselves, and we’re seeing it from the retailers who want to change the entire market dynamic.

It is, across the board, litigation. A new wave of litigation is hitting the courts.

People are very shortsighted, in my opinion, in not understanding that what they’re doing will, in the long term, harm their own self interest. People think they know the answer, but we’ll be there to defend a strong system.

|

|

PRINTER-FRIENDLY VERSION » |

|

|

E-MAIL THIS ARTICLE » |