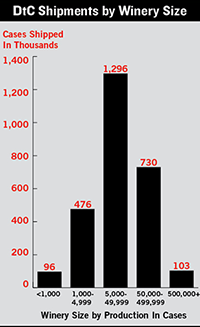

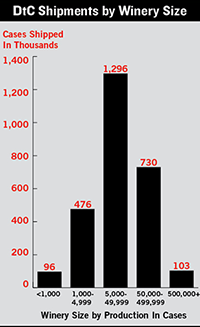

An exaggerated bell curve resulted when the Wines & Vines/ShipCompliant Shipment Model calculated the distribution of DtC shipments by the sizes of the wineries that ship them. All values are in 9L case equivalents. The smallest and largest wineries sent a very small percentage of all U.S. winery DtC shipments during calendar year 2010.

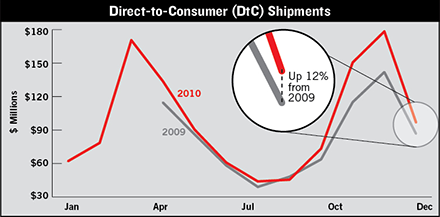

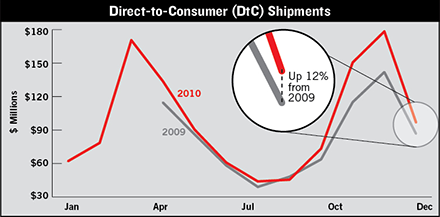

Our three leading indicators of wine industry health all ended 2010 better than 2009. In fact, all three led 2009 every month, except for a slight dip of the direct-to-consumer shipments during late summer. Domestic wine sales at retail finished the year at a steady 6% above 2009, while DtC shipments and the Winery Job Index both slipped closer to 2009 in December.

U.S. retail shoppers ended 2010 by spending 6% more on domestic table wine in December at major food and drug stores than they did during December 2009. The 52-week increase was also 6%. Import sales were flat and prices slightly down. Source: Symphony IRI Group.

Wineries shipped $97 million worth of wine direct to consumers in December 2010, beating December 2009 by a very healthy 12%, even as shipments made their normal seasonal dip down from the November peak. Source: Wines & Vines/ShipCompliant Shipment Model.

Winery job postings declined from November to December 2010, but they remained 6% higher than December 2009. It was the low point of a year in which every month saw more hiring activity than the corresponding month of 2009. Source: Winejobs.com.

SEE OTHER EDITIONS OF THIS COLUMN »

CURRENT COLUMN ARTICLES »