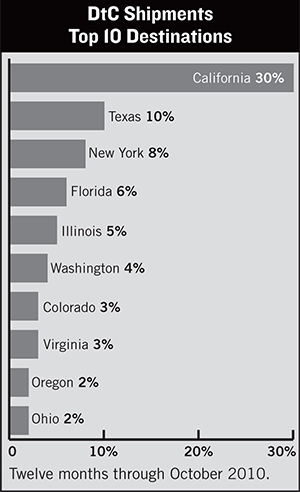

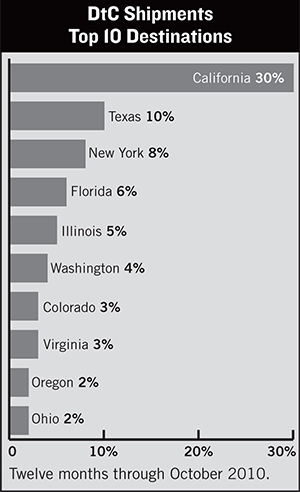

It's no surprise that California, with the largest state population as well as the most wineries per state (3,324, according to WinesVinesDATA), was the highest ranked destination state for direct-to-consumer wine shipments over the 12 months ending in October. Texas has many fewer wineries (190) but lots of appreciative wine consumers. It ranked second with 10% of the market. New York was not far behind, at 8%. The DtC data comes from a collaboration between compliance software firm ShipCompliant and Wines & Vines.

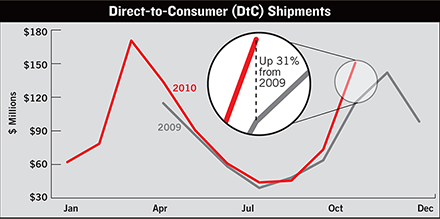

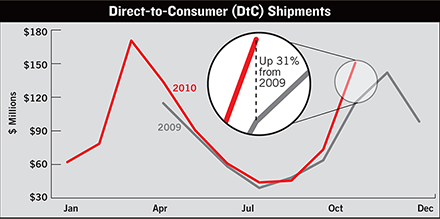

For the second month in a row, our three indicators of wine industry health have posted much better numbers than during the same period of 2009. Most impressive this time is the performance of direct-to-consumer shipments. The value of shipments leaped 31% for the month of October, bettering the already impressive gain of 15% in September. Domestic table wine sales stayed up, as did the Winejobs.com Index.

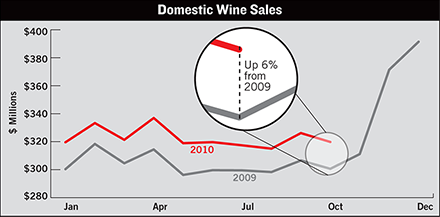

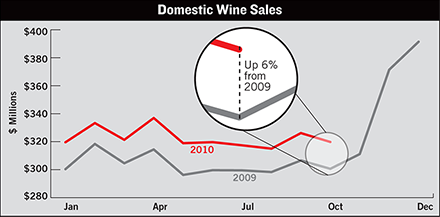

Off-premise sales of domestic table wine at major food and drug stores beat 2009 performance by 6%, even though sales through Oct. 3 dropped from the previous four-week period, according to checkstand scan data. Source: Symphony IRI Group.

Direct-to-consumer shipments from U.S. wineries shot up by 31% in value in October, passing the $150 million mark. It was the biggest year-on-year gain of any month measured in 2010. Source: Wines & Vines/ShipCompliant Shipment Model.

The Winejobs.com Index of winery job postings grew in October over the 2009 index for that month. The index dropped slightly from September, however, perhaps reflecting a curtailing of demand for harvest-oriented jobs. Source: Winejobs.com.