Wednesday, September 3Subscribe |

Forward this newsletter Good afternoon and welcome to WineBusiness' newest newsletter with the Data, Deals and Insights you need to better understand the U.S. wine market. Featuring the Industry Metrics by WineBusiness Analytics and partner research firms, the weekly Data, Deals and Insights newsletter is curated for winery owners, executives, winemakers, growers, suppliers, members of the trade and anyone else who wants to stay informed on the key trends driving the business of making and selling wine. Each issue contains the latest market data, news of the week's biggest business deals and the insights to connect it all. Data, Deals and Insights will be sent every week featuring the top business news of the previous week as well as original reporting and analysis from the editorial team producing the Wine Analytics Report and WineBusiness Monthly.

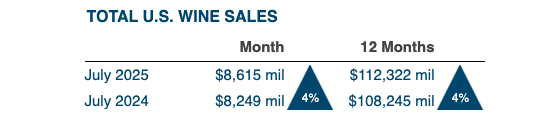

According to the most recent, preliminary figures by market research firm bw166, total spending on wine in the United States in July came to $8.6 billion, which is 4% more than in July 2024. Sales of imported sparkling wine grew by 21% to $5.5 billion in the off-premise market while on-premise spending on imported sparkling wine grew 22% to $2.7 billion. The gains in imports continue to help offset flat sales for domestic wines as the total market grew 4% to more than $112 billion of which off-premise sales accounted for $75 billion and on-premise claimed $37 billion. Total market volume, however, continues to decline as the post-pandemic baseline expected to be set this year proves elusive and may be lower than anticipated given weakening consumer sentiment coupled with wine's existing demand challenges. Sales volume of domestic table wines came to 204 million cases, which is 4% less than in the same period as last year while total market volume was 366 million cases or even with last year. Imports accounted for around 33% of total market volume in the past 12 months and were up nearly 8% to 123 million cases. That growth has been attributed to landing inventory in advance of expected tariffs, and while there was some hope that wine and spirits would be exempt given the nature of the U.S. three-tier beverage alcohol market; that hope has faded in the face of a 15% tariff on imports from the EU. As Peter Mitham reports in the August edition of the Wine Analytics Report: Just about the only certainty is that tariffs are the go-to tool for the current administration to achieve its trade and political objectives. “The willingness to enact broad tariffs on effectively every product from our most important trading partners is totally unique; we’ve never really experienced anything like this,” said Ben Aneff, president of the US Wine Trade Alliance (USWTA) and managing partner of Tribeca Wine Merchants in New York. “I don’t think anyone had any clue [of] the magnitude and scope that the president would be applying tariffs. Certainly, no one would have thought that huge, double-digit tariffs would be applied to effectively every product imported.” Tariffs range from a basic rate of 10% on most countries to 15% on goods from the EU, 35% on goods from Canada, and 50% on goods from Brazil and India. China faces a rate of 30%, but that could jump to 145% on Nov. 10 if it doesn’t reach a deal with U.S. trade negotiators. But it’s the tariffs on the EU that concerns the USWTA, which represents a broad coalition of interests drawn from all levels of the U.S. wine industry, including importers, wholesalers, retailers, restaurants and producers. USWTA estimates peg the value of EU imports sold in the US each year at $24 billion, but the value to the EU is $5.3 billion. This means about $18.7 billion of value is captured in the United States. “U.S. businesses make far more money on the sale of imported wines than the countries of origin do themselves,” Aneff said. “That economic surplus stays here at home in the United States, and it powers hundreds of thousands of jobs.” But it's not just the potential impacts of tariffs on EU goods in the U.S. market. The posturing and policies of the Trump administration have already resulted in dramatic losses in U.S. wine exports particularly in what had been the top single nation export market. While the Canadian government recently removed its own tariffs on U.S. products, the impact on consumer demand for American goods, particularly wine and liquor, has been dramatic, widespread and appears to be lasting.

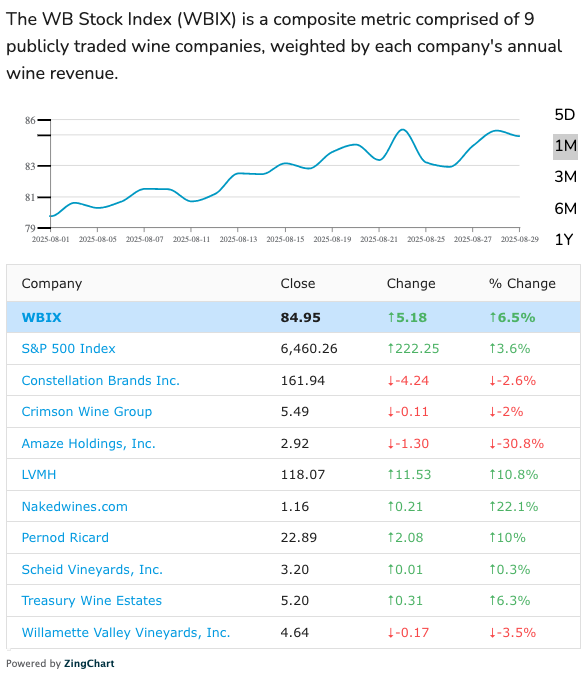

More from the August report: The ease with which consumers in Canada have shifted away from U.S. wine is also troubling. Many of the country’s government-run liquor stores quietly restocked shelves with alternatives, meaning U.S. product wasn’t conspicuous by its absence. Grocers went the low- and no-alcohol route, back filling shelves with sports drinks and sparkling water. Writing in a briefing note this spring, Jens-Peter Barynin, chief economist with analytics firm Vivi Economics, noted that while U.S. wines account for four of the top five wines sold in Canada, they weren’t irreplaceable. “Canadian consumers might notice the absence of U.S. wines, but they would adjust,” he said at the time. “U.S. share of the Canadian wine market was already shrinking over the past eight years — this conflict only accelerates that decline.” Consumer behavior since appears to have proven him right. “The content of the article still seems to be 100% on point,” he told the Wine Analytics Report. “The boycott of American wine has resulted in redirecting Canadian demand to other countries. It is clear when you look at the market shares.” The costs of the new tariffs will affect not just the U.S. wine trade and consumers but U.S. wineries as well. According to results from the 2025 WineBusiness Monthly Equipment Survey, 51% of wineries surveyed reported that tariffs have already directly increased their equipment costs this year with the biggest impacts seen in winemaking ingredients such as yeast and nutrients, lab supplies and spare parts for key equipment such as presses and filters. Given the downturn in the U.S. wine market, many wineries had already deferred major equipment purchases but nearly 40% of wineries surveyed said they had reconsidered major purchases for their bottling lines and crushpads because of the tariffs. In much lighter news, check out the winners from the 2025 PACK Design Awards in this webinar hosted by WineBusiness Monthly Managing Editor Erin Kirschenmann and Wine Analytics Report Staff Writer Sarah Brown. One of this year's winners is a compelling promotional tie-in with one of the greatest summer horror films ever made. Harvest continues, and picking has most likely picked up given the heat over the recent Labor Day holiday weekend. According to InnoVint's new Harvest Watch dashboards, the harvest in Napa and Sonoma counties has come to around 10% of average with some Cabernet vineyards in Napa County getting picked at an average Brix of 23 to 24 degrees while the valley floor was still at around 22 Brix. As first reported in last week's issue of this newsletter, it appears Breakthru was the big winner in securing distribution deals with wineries left without a wholesale partner in California after RNDC's exit from the state. The largest wine distributor in the United States, Southern Glazer's Wine & Spirits, wasn't far behind. WineBusiness Stock Index Sees Modest GrowthView the interactive WBIX at winebusiness: https://www.winebusiness.com/finance/wbix Other top business news:Understanding the Importance of Data Asset Protection Why Wineries Need to Pay Attention to Policies and Procedures Nate Garhart and MaryJo Lopez-Oneal, Farella Braun + Martel source: WineBusiness Monthly Loan Covenants: Why They Matter More Than Ever How to keep your bank on your side in a tight credit market source: WineBusiness Monthly Supreme Court is Next Stop for Wine Importer's Lawsuit Against Trump's Trade War A federal appeals court agreed with a ruling that the President overstepped when he imposed universal tariffs, but the decision has been stayed pending appeal to the U.S. Supreme Court source: Wine Spectator Casino Mine Buys Production Facility from Turley The acquisition will support "accelerating sales growth" for the Amador County producer source: press release Constellation Brands Issues Profit Warning on Weak Demand The Modelo brewer pointed to "volatile consumer purchasing behavior." source: Dean Best, Just Drinks SipSource Data Insights: Summer Depletion Trends Spirits may struggle more than wine to post growth as 2025 closes out. source: Wine & Spirits Wholesalers of America Southern Glazer's Wine & Spirits Names Steve Bronson as CIO Bronson will oversee enterprise technology strategy and execution, working closely with Southern Glazer's Digital Acceleration team to ensure the Company's technology roadmap supports its long-term digital transformation and growth objectives.Most recently, he served as Senior Vice President of Global Technology Infrastructure and Operations at McDonald's. source: businesswire AgTech innovation Hub Opens in Salinas Driscoll’s, Netafim, Nutrien, and Taylor Farms join as the newest key partners to transform agtech adoption across multiple U.S. regions and directly embed innovation within commercial farming environments. source: press release French winemaker jailed for selling millions of euros worth of fake champagne Courts found the winemaker added aromas and gas to wines from Spain and southern France to pass them off as the exclusive French sparkling wine, which can only be produced in the Champagne region. source: france24 |

Thanks for reading, and please contact us if you have comments, questions or a news tip and forward this email to a friend. You can sign up for our other great newsletters here - Andrew Adams To change your email address or contact information, click here. © 2025 Wine Communications Group, Inc. - all rights reserved |